south dakota property tax exemption

South Dakota offers property tax exemptions for installed solar systems. The exemption is portable for married couples.

Property Tax Homestead Exemptions Itep

South Dakotas average effective property tax.

. South Dakota Streamlined Sales Tax Agreement Certificate of Exemption Warning to purchaser. You will have a chance to review after signing. Not exempt Minnesota motels and hotels are not exempt North Dakota Ohio and West Virginia.

The property subject to this exemption is the same property eligible for the owner-occupied classification To be. Exempt property but is not completely accurate due to inconsistencies in the manner in which the property is valued and reported. Property tax exemptions allow businesses and homeowners to exclude the added value of a system from.

South Dakota Property Tax Exemption for Disabled Veterans. This is a multi-state form. 128 of home value Tax amount varies by county The median property tax in South Dakota is 162000 per year for a.

The federal estate tax has an exemption of 1170 million for deaths in 2021 and 1206 million for 2022. South Dakota Property Tax Exemption South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size. One hundred fifty thousand dollars of the full and true value of the total amount of a dwelling or.

Taxation of properties must. Exempts up to 150000 of the assessed value for qualifying property. Then the property is equalized to 85 for property tax purposes.

South Dakota Property Taxes Go To Different State 162000 Avg. The property subject to this exemption is the same. The governments from states without a sales tax are exempt from South Dakota sales.

Please fill in your name and email and then either draw or type your signature below. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. The first 50000 or 70 percent of the assessed value of solar energy systems less than 5 MWs whichever is greater is exempt from the real property tax.

Relief agencies and religious and private schools must apply to the department and. Property Tax Exemption for Disabled Veterans This program exempts up to 150000 of the assessed value for qualifying property. South Dakota property tax credit.

State law exempts certain entities from paying South Dakota sales tax or use tax on their purchases. There are about 5800 parcels of exempt property listed in the. South Dakota agricultural property owners with riparian buffer strips a vegetated area near a body of water have until October 15 to apply for a property tax incentive.

The statewide rate is 4. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised value and 4 be held taxable unless specially exempted. Partial exemption of dwellings owned by certain disabled veterans.

Signature will be applied to the page. There are two sections in the South Dakota Constitution that provide property tax exemptions. So even money you earn from a post-retirement job wont be taxed by the state.

South Dakota offers a partial property tax exemption up to 150000 for disabled Veterans and their Surviving Spouse. Create Your Signature. Sales tax is low in South Dakota.

I agree to electronically sign and to create a legally binding contract between the other party and myself or the entity I am authorized to represent. Not all states allow all exemptions listed on this form. Article XI 5 provides a property tax exemption for property of the United States and of the.

Other South Dakota property tax exemptions include the disabled veterans exemption which exempts up to 150000 of the disabled veterans property value from taxes.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How To Start Homesteading In South Dakota Hello Homestead

Property Tax South Dakota Department Of Revenue

States With No Income Tax Explained Dakotapost

South Dakota Department Of Revenue If You Are An Elderly Or Disabled Person Find Out If You Qualify For A Tax Assessment Freeze Deadline Approaching Soon For More Information Visit Https Dor Sd Gov Newsroom Tax Assessment Freeze Program

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

Relief Programs South Dakota Department Of Revenue

South Dakota Estate Tax Everything You Need To Know Smartasset

Department Of Revenue Reminds Homeowners Of Property Tax Relief Deadline Knbn Newscenter1

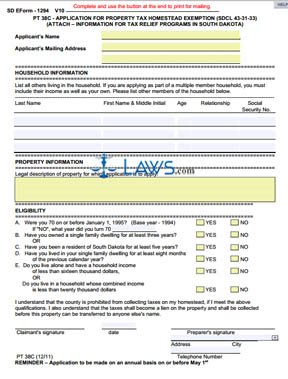

Free Form Pt 38c Application For Property Tax Homestead Exemption Free Legal Forms Laws Com

South Dakota State Veteran Benefits Military Com

Historical South Dakota Tax Policy Information Ballotpedia

Are There Any States With No Property Tax In 2022 Free Investor Guide

Do You Know Your Homestead Exemption Deadline

Tangible Personal Property State Tangible Personal Property Taxes

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)